Big Data & Analytics for Banking Summit brings together analytics executives and data scientists working in banking and financial services, offering unique insight into the innovations that are driving success in these industries. With greater constraints and challenges facing the banking industry every day, hear how forward-thinking organizations are driving success in an immensely competitive market.’

Why Attend?’

- 25+ industry expert keynote presentations

- 150+ Banking professionals attending

- Interactive workshops with industry leaders

- Over 20 hours of networking opportunities included

- Access to online presentations on-demand post-summit

- 20+ case studies presented from leading financial institutions

- Interactive panel sessions and engaging round tables

There is no question that IE. provides the gold standard events in the industry and will connect you with decision makers within the analytics industry. You will be meeting senior level executives from major corporations and innovative small to medium size companies.’

Big Commitment, Bigger Benefits’

We cover the topics that matter most to today’s big data & analytics leaders and then top it all off with a healthy dose of creativity-enhancing inspiration & innovative action points and takeaways’

Online videos of all sessions, with integrated slides and audio will be made available to all attendees after the event via our ieOnDemand service’

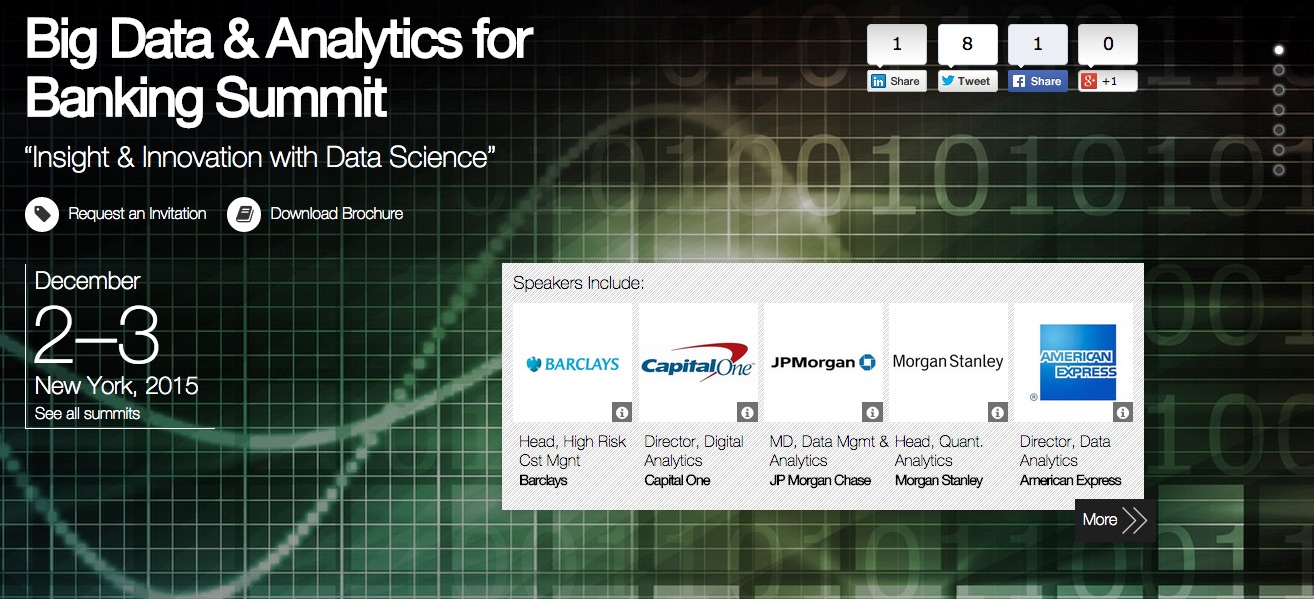

Hear case studies from the best names in the industry. The most influential speakers fly in from around the world to present their expertise!’

The Big Data & Analytics in Banking Summit brings together acclaimed speakers and attendees for deep insight into how the banking and financial service industries uses analytics and data science. The summit will also address how banks can tap into the vast amount of historical data that they possess. Across many industries, large and small organizations are using analytics and data science to offer greater insight and customer service. As the banking and financial services industries embrace these developments as well, areas such as digital banking, combatting fraud, setting insurance premiums and mining social media for customer insight offer new ways to drive profit through the use of data.