Globalization is under attack. America elected Donald Trump on the premise that he will slow the advance of economic globalization and bring back jobs that companies are outsourcing to countries with cheaper labor. He promises to raise tariffs on imports in an effort to incentivize domestic production. In the UK, Brexit will forcefully remove Britain from the European Union’s marketplace.

Yet global business will continue regardless of the current temperament–and so will cybercrime. Proponents of globalization must ask themselves whether the centralization of massive amounts of data, which enterprises generate through their operations worldwide, is a powder keg waiting to explode.

Hackers have profits as priority number one. So do corporations. The most tempting big data trove is financial data, and enterprises create plenty of it when they do payroll, working with data from thousands of employees in multiple countries.

The future of corporate globalization will see increasing sophistication from both data security officers and those that seek to hack security measures. Officers will need experience in digital forensics, which incorporates all types of digital devices, the internet, and the cloud. The question is, who will win, hackers and thieves, or security personnel? The answer may determine whether globalization as we know it continues to be a reality.

Increasing complexity

More and more companies are doing business globally, and with that comes the need for a cloud-based payroll solution. In terms of global payroll, in 2016 53% of organizations planned to adapt to SaaS on the cloud, a 12% rise from 2015. This reflects the growing power and wealth of multinational corporations. In 2014, there were 63 corporations among the world’s top 100 economic entities; in 2015 there were 69.

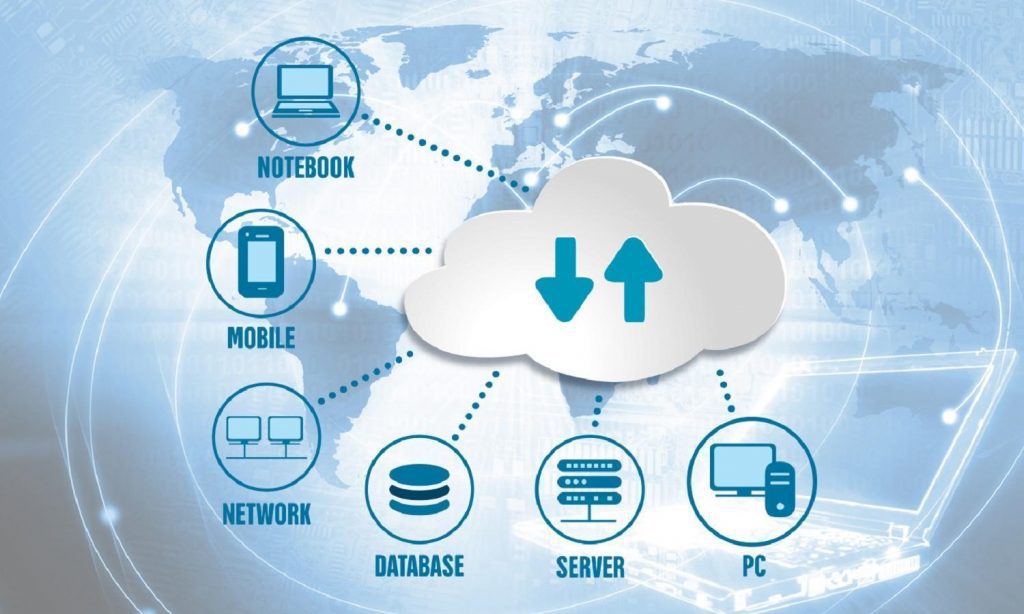

The reason why the cloud is becoming the place for multinational corporations’ payroll is simple: it’s far easier to do all your work in one place. Controllers and other financial personnel can access all data regarding employee hours and pay rates, all over the world, from one location. Then, they can make sure payments comply with each country’s tax code, regulations, and other requirements.

This picture looks good because the overall digitization of business requires good software solutions and solid cloud infrastructure, and the marketplace isn’t lacking in either of these. But the picture isn’t as rosy as it seems. Globalization is actually on a downturn, cybercrime is on the rise, and people are losing jobs to machines.

To be clear, multinational corporations are still huge. They account for over 50% of world trade, and makeup 40% of total value in the West’s stock market. They employ 2% of the workforce. That number isn’t bigger because robots can increasingly do a great deal of the manufacturing. What’s more, multinationals’ profits are falling. Over the last five years, profits recorded by the top 700 multinational firms based in rich countries have fallen by 25%. For American firms, the profit drop was 12%. In 8 out of 10 sectors, multinationals performed worse in aggregate sales than domestic firms.

Furthermore, criminal behavior is changing: cybercrime costs the global economy $400 billion per year, and that number continues to rise, while traditional crime rates go down. In terms of cybercrime trends, nearly 92% of hacks happen in the US, where tech companies have also been the most successful at going global, outperforming all other American multinational companies in the top 50. While America is a hotbed of tech, it’s also a hotbed of hacking.

To cloud or not to cloud: that is the question

For many companies, once they hit a certain size, going global is inevitable. The infrastructure is in place, and choosing to only sell domestically means choosing not to grow. Although there is uncertainty in the worldwide marketplace because of Trump’s policies, the shaky standing of the European Union, and other factors related to regulation and conflict, globalization will continue until governments put an absolute stop to it.

As it continues, firms will look to the success rate of the cloud in terms of its security for payroll data. By 2018, one-third of the worldwide enterprise application market will be SaaS-based as 71% of cloud services focus on serving enterprises. At the same time, enterprises face an average of 23 cloud-related threats per month. Only about 8% of cloud providers are able to provide the strict level of security measures and privacy protection standards enterprises need.

With globalization of business already in jeopardy, these statistics aren’t promising for financial SaaS at a global enterprise level. But there are several solutions. It sounds simplistic, but if enterprises prioritize cybersecurity, it will mitigate risk. The components of cybersecurity include:

- An up-to-date firewall

- Anti-malware software

- A comprehensive security policy and well-briefed employees

- Access to a first-response team when cyberattacks do occur

- Layered security, including multifactor authentication, SSO, EV, and SSL

- Cybersecurity training for employees

- A high level of scrutiny and doubled-down security for admin accounts

These components combine up-to-date technology with training and knowledge. Another solution could come in the form of a decentralized cloud that relies on blockchain technology. Bitcoin users already exchange Bitcoin on the secure blockchain, why not use that model for SaaS? Hackers would have a much harder time compromising financial data encrypted and housed on billions of devices, devices that could only surrender the data to miners with Application-Specific Integrated Circuits in irreversible transactions.

Ultimately, as it becomes harder for them to make a profit on the global market, enterprises are at too large of a loss if they don’t prioritize cyber security. If hackers win this battle, we may not see enterprises as global entities after the year 2020. If enterprises win with education, secure technology, and innovation through the blockchain, global business will thrive.